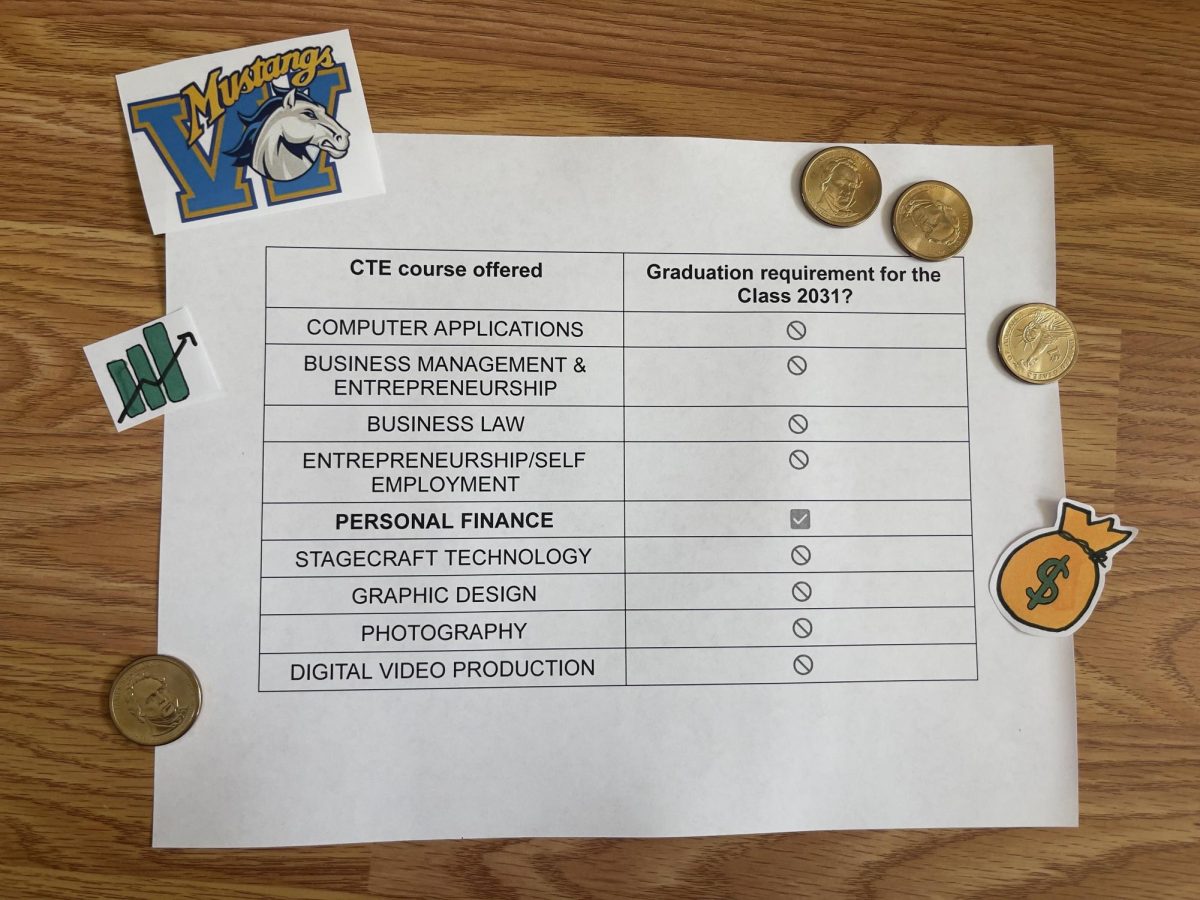

Personal Finance curriculum will be added as a new graduation requirement for the class of 2030-31 onwards.

On June 29, 2024, governor Gavin Newsom approved Assembly Bill (AB) 2927 which establishes personal finance as a necessary course to graduate high school and addresses the approval of a curriculum guide by the State Board of Education. The approval was confirmed on Jan. 15, 2025 along with a draft development timeline for the Personal Finance Guide which aims to be finalized on May 31, 2026. According to the California Department of Education, personal finance will be a required one-semester class but will also be offered as a year-long course. Under the bill, high schools are required to offer the personal finance course for the class of 2027-28 even though it will not be part of the A-G graduation requirement for them.

“[Although it’s not required], you’re going to have to deal with [finance] beyond high school no matter if you want to or not. So you might as well understand things like taxes. All that stuff is going to be part of what you have to do in your daily life, so it would be a good class for everybody,” economics teacher Nick Madrid said.

This course will involve fundamentals in budgeting, uses and effects of credit, uses and costs of loans, impacts of the tax system and many more topics relating to personal finance. The course will promote responsibility in finance by teaching students financial knowledge and skills that will help them economically in life.

“Learning financial management helps students make informed decisions about budgeting, saving and investing, equipping them for real-world responsibilities. It prevents debt, encourages smart spending habits and reduces financial stress, leading to long-term stability. With financial literacy, students gain confidence, career opportunities and the ability to achieve long-term financial goals,” Director of Student Services and Secondary Education Dr. Ryan Maine said.

Besides students, teachers and administrators will gain benefits from this new graduation requirement. For example, this guide from the state board, will be easily accessible for teachers with or without educational experience in finance. It will provide real-world scenarios and case studies for students to explore. It will also include different ways teachers can involve students and parents, such as through projects and showcases. In order to stay updated with personal finance, the guide encourages them to pursue professional learning opportunities.

As the Personal Finance guide develops, different topics such as renting an apartment, buying a house and digital financing will be taken into consideration. All these factors will assist students in understanding the world of finance.

“I don’t feel prepared for entering college and adult life because I don’t know anything about finance. But I think [the course] sounds like a good idea since it wouldn’t just prepare students academically but also financially when they go out into the real world,” junior Kristie Trieu said.